Editing Time Cards: Is It Illegal to Change Employee Time Cards?

Is it illegal to change an employee's time card? The short answer is no. An employer can legally change time cards. But we shouldn't stop there because the Fair Labor Standards Act (FLSA) demands you understand what legal time card changes are, or a federal court may hit you with 3.6 million reasons to give it deeper thought. And it's a good question to ask because your employees are asking Google, "Can my employer adjust my time card?"

Efficient time card management is critical to running a smooth and successful small business, especially with mobile employees. While most employers are very concerned about employee time theft, they must be equally careful with time card manipulation or wage theft to avoid breaking employee time card laws. We'll break down this challenging topic into easy-to-understand steps to explain when you can and can't modify time cards.

Are you ready to try a GPS time clock app that ensures employees are at the job site when clocking in?

Short Summary

-

Understand the FLSA's stance on labor violations, such as an employer falsifying timesheets, and learn the consequences, including penalties, back pay, and liquidated damages.

-

Ensure overtime pay is correctly paid and accurate payroll records are maintained to avoid legal repercussions.

-

Adopt an employee timekeeping system and incorporate best practices for timecard management.

Table Of Contents

- Time Card Management Definitions

- Understanding the Fair Labor Standards Act (FLSA) and the Duty to Keep Accurate Records

- Legitimate Reasons to Adjust Employee Timecards

- Unlawful Timecard Manipulation, Alterations, and Consequences

- Best Practices for Timecard Management

- 7 Reasons to Adopt Chronotek Pro as Your Automated Timekeeping System

- Summary

- FAQs

Time Card Management Definitions

Discussing timesheet manipulation gets complicated, so let's begin with a few essential definitions.

Department of Labor (DoL): A U.S. government agency that enforces and promotes labor laws and standards. Its mission is to protect and enhance the welfare of workers by overseeing workplace safety, fair wages, employment benefits, and other aspects related to labor and employment.

Fair Labor Standards Act (FLSA): A U.S. federal labor law that establishes minimum wage, overtime pay, recordkeeping, and child labor standards affecting full and part-time workers in the private sector and in Federal, State, and local governments.

Wage and Hour Division (WHD): A division of the DoL responsible for enforcing federal labor laws, including minimum wage, overtime pay, recordkeeping, and child labor requirements of the FLSA.

Nonexempt employee: A U.S. worker entitled to earn at least the federal minimum wage and qualify for overtime wages when they work more than 40 hours a week.

Exempt employee: An employee not covered by the minimum wage and overtime provisions of the FLSA. Exempt employees are paid on a salary basis, not by the hour, and have more responsibility than others, such as executive, administrative, or professional roles.

Independent contractor: A worker who doesn't meet FLSA standards to be considered an employee and doesn't qualify for overtime compensation.

Hours worked: Covered employees must be paid for all hours worked in a workweek, even if you round time with the 7-minute rule. In general, “hours worked” includes all time an employee must be on duty, or on the employer’s premises or at any other prescribed place of work, from the beginning of the first principal activity of the work day to the end of the last principal work activity of the workday. Also included is any additional time the employee is allowed (i.e., suffered or permitted) to work. (FLSA definition)

Liquidated damages: An additional amount of compensation that may be awarded to an employee who has successfully pursued a claim for unpaid minimum wages or overtime. The FLSA defines the amount as “unpaid minimum wages, or their unpaid overtime compensation, as the case may be, and in an additional equal amount as liquidated damages."

Understanding the Fair Labor Standards Act (FLSA) and the Duty to Keep Accurate Records

The FLSA is a federal law that requires employers to maintain accurate records of the hours worked by nonexempt employees, including the following information:

-

Time and day of the week when the employee's workweek begins

-

Hours worked each day

-

Total hours worked each workweek

-

The basis on which employee's wages are paid (e.g., "$9 per hour", "$440 a week", "piecework")

-

Regular hourly pay rate

-

Total daily or weekly straight-time earnings

-

Total overtime earnings for the workweek

The FLSA allows employers to use any timekeeping method they choose as long as time records are accurate and complete. Employers can use handwritten time cards, time clocks, or an automated time clock system. Time card adjustments are allowed as long as they represent the actual hours worked. We'll discuss valid reasons for adjusting employee time cards and what constitutes unlawful changes.

In addition to federal guidelines, employers must follow state laws when recording work hours. When the FLSA and state laws conflict, the employer must adhere to the employee time card lawslaw that benefits the employee most.

Legitimate Reasons to Adjust Employee Timecards

Employers have valid and legal reasons to change time cards as long as the adjustments account for all hours worked by the employees. We'll discuss a few of the most common reasons to change time cards legally.

To Edit Time Sheet When An Employee Forgets to Clock In or Out

When an employee forgets to punch in or out, you can record the time on the employee's time card. Or perhaps the time-tracking app had technical issues. Any employee oversight or inability to punch in or out doesn't relieve you from the duty to pay nonexempt employees for this time worked.

To Adjust for Paid Vacation or Sick Leave

The FLSA does not require employers to give nonexempt employees paid vacation or sick leave, but they can be part of an employment contract. Companies that pay nonexempt employees for vacation or sick leave can add the hours to the employee's time sheets. Or if the employee calls in sick or leaves early due to sickness, you can adjust the time records to reflect the paid sick time.

To Modify Time Sheets for Discrepancies and Inaccuracies

If an employee makes a mistake on a paper time sheet or double-punched a time clock, you can modify the employee's time. If you see a reason to adjust an employee's time card and have doubts about the correct hours, contact the employee to confirm.

Unlawful Time Sheet Manipulation, Alterations, and Consequences

Any attempt to pay your nonexempt employees less than the total hours worked is illegal, even if your employees agree. For instance, in the Santonias Bailey v TitleMax of Georgia case, plaintiff Santonias Bailey filed a lawsuit under the FLSA. Bailey claimed he didn't receive overtime payment during his one-year employment at a TitleMax store because his supervisor warned him that the company didn't pay overtime. As a result, Bailey underreported his time, and the supervisor altered the employee's time records to avoid paying overtime.

TitleMax argued that Bailey was responsible due to his violations of company policy, including inaccurate reporting of hours, failure to verify time records, and not reporting work-related problems (his supervisor's actions). The district court sided with TitleMax, dismissing Bailey's claims.

The United States Court of Appeals, Eleventh Circuit, overturned the decision. It ruled TitleMax had knowledge or should have known about Bailey's overtime work, as his supervisor encouraged underreporting and hindered accurate timekeeping, as outlined by federal regulations. The Court stated, "Knowledge may be imputed to the employer when its supervisors or management encourage artificially low reporting.”

In other words, the employer is responsible for the actions of its supervisors.

The DoL issued a memo on August 24, 2020, clarifying an employer's responsibility to track their employees' time. The memo states, "If the employer knows or has reason to believe that work is being performed, the time must be counted as hours worked." Further on, the memo states, "But the employer cannot implicitly or overtly discourage or impede accurate reporting, and the employer must compensate employees for all reported hours of work." Finally, the memo says an employee can't waive their rights to compensation.

The DoL is clear about the employer's duty to maintain accurate records:

-

Employers can't falsify an employee's time card to avoid paying OT

-

Employers are responsible for the actions of their supervisors and managers

-

Employees can't waive their rights to compensation for hours they worked.

Additionally, you can't modify employee time as a form of punishment or to avoid paying for authorized breaks. Let's examine another way employers prevent paying overtime hours that the DoL considers illegal.

The Misclassification of Workers to Avoid Paying Overtime

This violation isn't directly related to timesheet manipulation, but companies sometimes misclassify workers as salaried or contractors to avoid OT pay, which can be a costly mistake. A Tennessee home healthcare service provider misclassified 50 workers as independent contractors and, after a DoL investigation, was forced to pay $358,675 in back wages to resolve overtime violations.

Let's discuss what you need to know about classifying your workers.

Exempt or Nonexempt (Salaried or Hourly)? The Exemption Test

The FLSA has five main exemption tests to determine if a job qualifies for overtime pay. All work is considered non-exempt by default unless the employer proves it's not with one of the FLSA exemption tests.

The FLSA five exemption tests are:

-

The Executive Test: Must involve managing the company or a recognized department, meeting the salary threshold, overseeing the work of at least two full-time employees, having the authority to hire and fire, and making important recommendations that carry weight.

-

The Administrative Test: Must first meet a salary threshold and have a primary duty of performing office and support tasks related to managing the overall business operations of employees or customers. This includes exercising discretion and independent judgment in making decisions based on priorities.

-

The Professional Test: Must meet the salary requirement and possess advanced knowledge and expertise to make informed and discretionary decisions primarily based on intellectual matters in a specialized field of science or learning.

-

The Outside Sales Test: The primary work involves sales or contracts for services or goods, with a crucial requirement being that the employee operates predominantly outside the office, engaging in activities related to finding and finalizing business transactions.

-

The Computer Test: Must work in a computer-related field and be involved in tasks such as systems analysis, software development, and program modification. They must also meet the salary threshold.

Nonexempt Employee or Independent Contractor?

No single rule or test exists for determining if a worker is classified as an employee or independent contractor. The employer-employee relationship under the FLSA is tested by "economic reality" rather than "technical concepts." The DoL established an "economic reality" test using five factors to determine if a worker is an employee or an independent contractor:

-

The nature and degree of the worker’s control over the work (core factor)

-

The worker’s opportunity for profit or loss based on initiative and/or investment (core factor)

-

The amount of skill required for the work

-

The degree of permanence of the working relationship between the worker and the potential employer

-

The extent to which the work is part of an integrated unit of production

Employers are prohibited from misclassifying employees, even if there is mutual agreement. Consult with your legal advisor if you have any doubts if your worker is exempt, nonexempt, or an independent contractor. Don't let a misunderstanding put you in violation of federal and state laws.

Legal Repercussions and Penalties for FLSA Violations

Employers who ignore the FLSA's standards for accurate timekeeping and illegally change time cards may face serious legal consequences. When employers violate minimum wage and overtime rules, the DoL works with employees to recover back pay plus an equal amount in liquidated damages, attorney fees, and court costs. A 2-year statute of limitations applies, except in cases involving willful violations by the employer in which a 3-year statute applies.

Employers that violate employee time card laws can also face monetary, criminal, and civil penalties.

-

Overtime violations: a civil penalty up to $1,000 for each violation

-

Minimum wage violations: a civil penalty up to $1,000 for each violation

-

Child labor violations: a civil up to $10,000 for each child worker who was employed

-

Willful violations of the FLSA: penalties up to $10,000 and criminal prosecution; a second conviction may lead to imprisonment.

In January 2023, the DoL found guilty a Nevada-based paint contractor of violating the FLSA. The employer cheated almost 600 workers out of $1,809,249 in back wages, falsified records, and threatened employees if they complained to the DoL. The federal court awarded the employees their back wages and an equal amount in liquidated damages, totaling over $3.6 million.

The State of New York made wage theft a felony in September 2023. The wage theft bill (S2832-A/A154-A) amended section 155.05 of the New York Penal Law to state: “Larceny includes a wrongful taking, obtaining or withholding of another’s property, with the intent prescribed in subdivision one of this section, committed in any of the following ways: … (f) By wage theft. A person obtains property by wage theft when he agrees to hire a person to perform services and the person perform such services and the defendant withholds such wages from said person.”

Let's discuss how your company can stay off the government's radar.

Best Practices for Timecard Management

Timecard management is serious and can lead to unwanted legal problems if taken lightly. Use best practices for managing timecards. These best practices include:

-

Clear timekeeping policies: Establish and communicate clear policies regarding time tracking, including rules for clocking in and out, meal breaks, and overtime.

-

Consistent enforcement: Ensure consistent enforcement of timekeeping policies and promptly address violations. This helps maintain fairness and accountability in time-tracking practices.

-

Regular training and education: Train employees to record their time and adhere to timekeeping policies accurately. Keep employees informed about any updates or changes to the timekeeping process.

-

Routine review and reconciliation of time records: Regularly review and reconcile timecard data to identify discrepancies or errors. Address any issues promptly to maintain correct records.

-

Active employee engagement: Involve employees in the timekeeping process by encouraging them to keep track of their hours and report any discrepancies or concerns.

-

Proper documentation: Maintain organized and secure records of timecards and related documents as the law requires. This helps with compliance and provides a reference for future audits or disputes.

-

Professional guidance: If needed, consult with HR professionals, employment law attorneys, or payroll experts to ensure your timecard management practices align with legal requirements and industry standards.

These are critical steps to ensuring compliance with employee time card laws, maintaining correct records, and being transparent with employees. Let's discuss the best way an employer can manage employee time cards now.

7 Reasons to Adopt Chronotek Pro as Your Mobile Workforce Management Solution

The statement warrants repeating - employers are responsible for paying nonexempt employees for every hour and minute they work. When the DoL issued a memo in 2020 about tracking time for remote employees, the subject line was, "Employers’ obligation to exercise reasonable diligence in tracking teleworking employees’ hours of work."

Let's discuss seven reasons why adopting Chronotek Pro as your automated timekeeping system is the best way to exercise reasonable diligence in tracking remote employees' time.

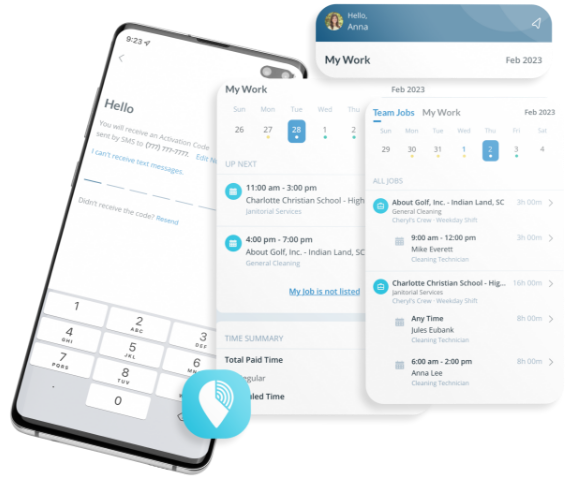

1 - Improved Accuracy in Capturing Hours Worked and Reporting Issues

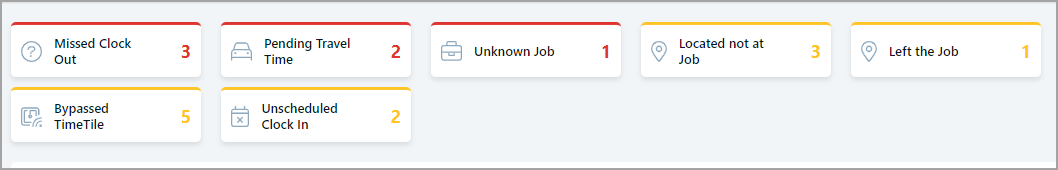

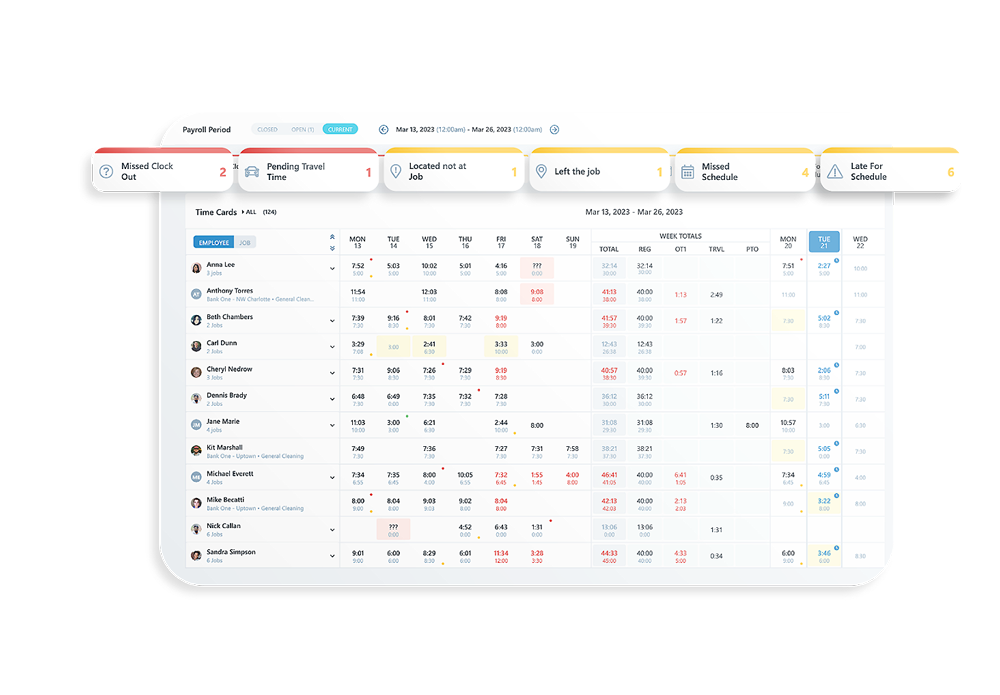

Chronotek Pro's GPS time tracking app records time cards to the precise minute and provides clear timestamps, eliminating inaccurate time often recorded on paper timesheets. Pro has a live dashboard that tracks time sheet issues, such as when employees clock in or out away from the job site and forget to clock out. The image above shows 3 missed clock outs. You can click on the tile to see who the employees are and send them a message through the system to get their hours worked. Pro eliminates the need for too many time card changes by capturing accurate time and reporting clock-in issues.

2 - Enhanced Communication with Your Mobile Workforce

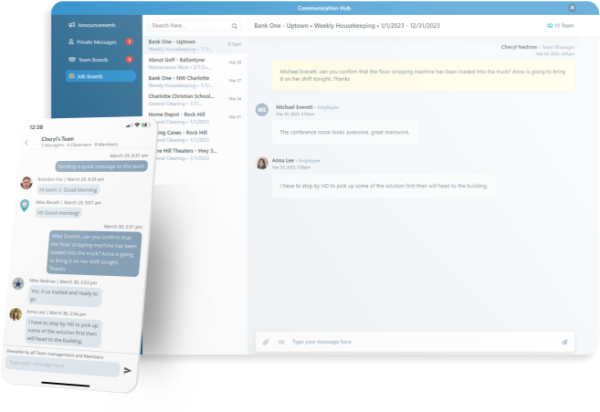

Clear two-way communication between management and employees is vital for time card management. Both sides need a path to report and question time card discrepancies, reasons for missed punches, late arrivals, etc. Chronotek Pro has team and job boards, private messaging, and required-read company announcements in your employees' native languages. Good communication flow will help maintain accurate records and ensure you have the correct information for time card changes.

3 - Simpler Management Processes for Tracking Work Schedules

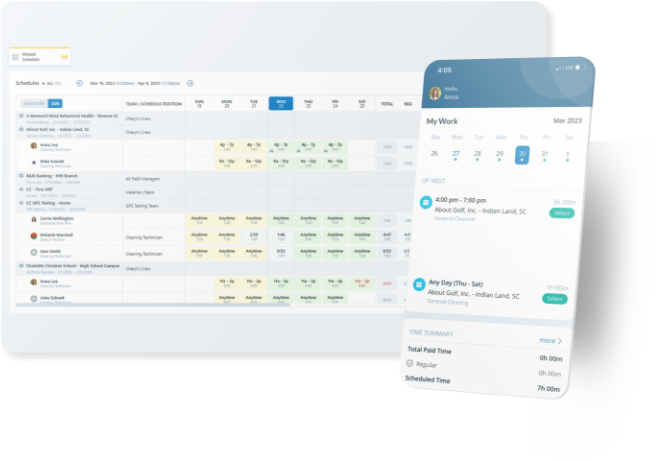

Chronotek Pro has advanced schedule views to monitor employee hours scheduled. Compare scheduled hours against hours worked on one screen. While you must pay employees for total hours worked, you may discover valid reasons to adjust schedules in the future or question the employees about the discrepancies. Easy visibility of scheduled and actual hours worked is essential to maintaining accurate records and avoiding the appearance of time card manipulation.

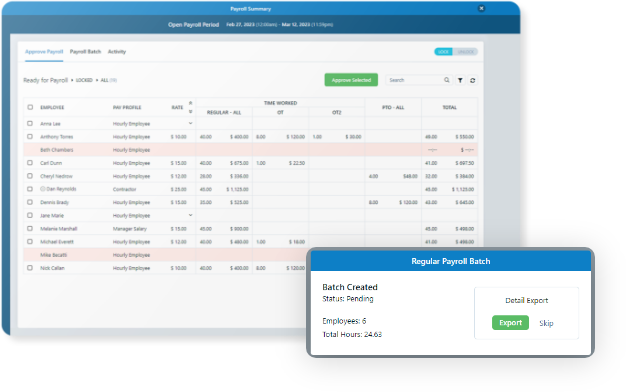

4 - Live Reporting of Regular Hours and Overtime Hours

When relying on handwritten timesheets, you only know how many hours you're paying once you collect the timesheets. You hope employees stick to their schedules and don't fudge their hours worked, but how do you know? You have a legal duty to pay employees for all hours worked and must have a compelling reason to change time cards. However, Chronotek Pro's live time card dashboard automatically reports hours worked, including overtime hours as they occur. You'll never be in the dark again guessing about the need for time card adjustments.

5 - Increased Visibility for Employees to Their Time Cards

As in any relationship, transparency and open communication are the best ways to avoid appearances of impropriety. The Pro mobile app gives employees access to track and review their hours. When they see discrepancies in their hours, they can communicate these concerns with their supervisor through the app. Transparency and open communication with your employees will keep your record clean with the DoL and boost your employee retention efforts.

6 - Easier, Error-free Payroll Processes

A nonexempt employee isn't always shorted on pay due to flagrant time card manipulation. The Washington Business Journal article reports that a payroll admin's reading and typing mistakes can cost up to 8% of annual gross payroll. The best practice for an employer with hourly employees is to automate its payroll processes with an online timekeeping system such as Chronotek Pro.

7 - Advanced-level NFC Technology Ensures Time Cards Are Accurate

Capturing accurate clock-in and out times for hourly employees is the first step in complying with FLSA guidelines and avoiding a need to modify time cards. In addition to a GPS time clock app, Chronotek Pro has NFC-enabled TimeTiles™ to ensure accurate time cards and employees clock in at the job site. TimeTiles™ are tamper-proof, weatherproof 2 ½” square PVC tiles that you code to each job site location and employees scan to clock in. TimeTiles™ makes it easy to have accurate time that needs little or no adjustments.

Summary

Companies must adhere to FLSA guidelines when managing employee time cards. Employers can maintain accurate records and avoid legal trouble by adopting best practices for time card management, such as clear policies, consistent enforcement, regular training, and proper documentation. An automated timekeeping system, like Chronotek Pro, can further streamline the process and ensure compliance with labor laws. Remember, prioritizing accurate time card management is essential for legal compliance and fostering a fair and transparent working environment where employees' rights are respected.

Is it illegal to change an employee's time card? No, but now you understand why a short answer didn't suffice.

Frequently Asked Questions

1 - Why is accurate time card management important for employers?

Accurate time card management ensures proper payment of wages and compliance with labor laws.

2 - Can employers legally change timecards?

Yes, employers can change time cards, but it must be done in compliance with FLSA guidelines and should accurately reflect the hours worked by employees.

3 - How can companies avoid FLSA labor violations?

Companies can avoid time card fraud punishment by understanding and complying with FLSA regulations, maintaining accurate time records, following best practices for time card management, and seeking an experienced employment lawyer if needed.

4 - What are some best practices for employers in time card management?

Best practices include adopting clear timekeeping policies, consistently enforcing them, providing regular employee training, conducting routine audits, and using reliable time-tracking systems.

5 - How can a time-tracking system help small businesses ensure compliance with the DoL?

Time tracking systems automate recording and calculating employee work hours, reducing the chances of errors, ensuring accurate records, and providing a reliable source of information for compliance purposes.

6 - What are the key provisions of the FLSA regarding time card management?

The FLSA requires employers to maintain accurate time records, pay employees for all hours worked, properly track overtime hours and prohibits retaliation against employees who assert their rights under the FLSA.

7 - How long should employers keep time card records?

The FLSA recommends employers retain time card records for at least two years. However, it's advisable to check with local labor laws as they may have additional requirements.

8 - Can employees waive their rights to pay for hours worked?

No, employees cannot waive their rights to compensation for hours worked. Regardless of any agreement or understanding, the FLSA requires employers to pay employees for all hours worked.

9 - What are the penalties for illegal time card manipulation?

Penalties can include back-pay awards, liquidated damages fines, legal fees, and potential criminal charges for willful violations. A company can commit time card fraud employee commits time fraud

10 - How can employers ensure fairness and transparency in time card management?

Employers can ensure fairness and transparency by adopting clear and consistent policies, providing employees with access to their timesheets, encouraging open communication regarding discrepancies, and promptly addressing concerns or questions.

Please note that these answers are for informational purposes and shouldn't be considered legal advice. Employers should consult legal professionals for specific guidance on time card management and compliance with labor laws.

Conclusion

In conclusion, while it's not inherently illegal for employers to change an employee's time card under certain circumstances, such as correcting errors or adjusting for missed punches, doing so without proper documentation or employee consent can raise legal and ethical concerns. It's essential for employers to establish clear policies and procedures regarding time card management, ensuring transparency and fairness in their timekeeping practices. Moreover, compliance with labor laws and regulations, particularly regarding overtime pay and accurate record-keeping, is paramount to avoid potential legal liabilities and penalties.

By fostering a culture of accountability, communication, and adherence to best practices in time card management, employers can mitigate risks associated with time card mismanagement and promote a harmonious work environment built on trust and integrity.

By embracing these solutions, you can simplify payroll processes, reduce administrative burdens, eliminate time theft, and minimize costly mistakes. Invest in an automated time clock system to save time and money while ensuring accurate and efficient payroll calculations. With the right tools and processes, you can focus on more strategic aspects of your business and watch your profits grow.